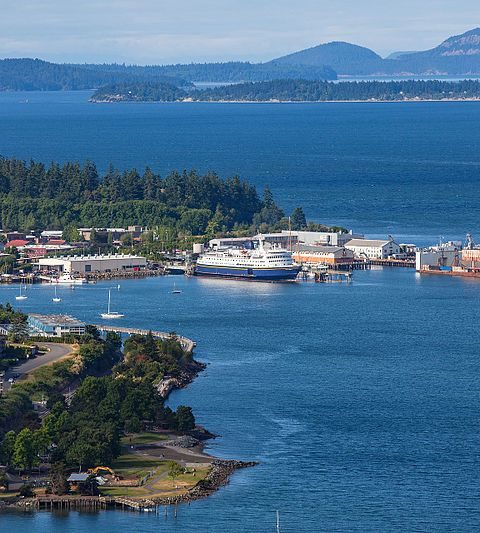

Vancouver, Wash. – Maul Foster & Alongi, Inc. (MFA), a leading Pacific Northwest multidisciplinary firm, is excited to announce the acquisition of Peak Sustainability Group, a respected Bellingham, Washington-based firm specializing in climate change and sustainability services. The acquisition of Peak reflects MFA’s ongoing commitment to environmental stewardship and sustainable business practices. This partnership enables MFA…

Exxon warns investors of climate risk

Exxon/Mobil admits that fossil fuels are risky

Exxon warns investors of climate risk. When Exxon/Mobil admits that fossil fuels are risky, that’s saying A LOT. Our nation’s largest oil company’s board evaluated climate change as a significant business risk. This risk is on par with operational, strategic, and financial risks that are usually taken into account when apprising a company’s future profitability.

Exxon wrote off 26 billion in 2020

The pandemic showed the company what a decline in oil and gas demand looks like. The picture wasn’t pretty with Exxon writing down the value of its property, plants, and equipment by nearly 26 billion in 2020. That is more than a 10% correction. For 2020, Exxon had the worst financial performance in 40 years. Other fossil fuel giants like Chevron lost money too.

For a fossil fuel giant to admit to this kind of risk is a telling about-face. It’s clear the recent board “shake-up” at Exxon has resulted in a shake-up for the entire industry. Their admission to lower returns for investors is a shot off the bow signaling rough waters ahead. However, risk is something corporate understands and the pandemic gave them enough taste of what’s coming to see the need to communicate something they’ve not admitted to – climate change risk.

Exxon board calls for unprecedented collaboration

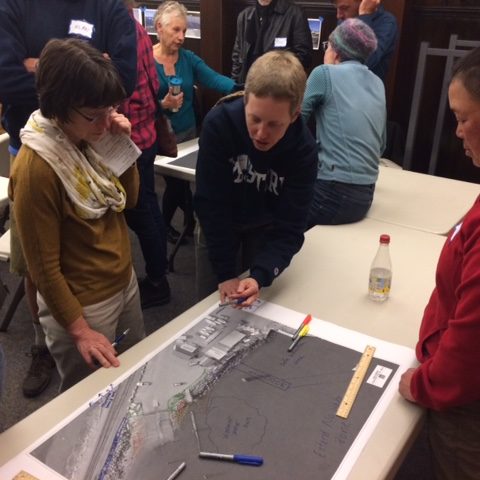

With the addition of a new activist board member in June 2021, Exxon’s statement of risk included a need for unprecedented collaboration among governments, private companies, consumers and other stakeholders to create meaningful solutions that will meet the world’s increasing demand for affordable and reliable energy.

This Bloomberg article discusses the role of the Exxon board when shareholders went against Exxon and supported the disclosure of political- and climate-lobbying activities. With a new board member vying for a seat, the old guard cast typical warnings about adopting an outsider which would “derail our progress and jeopardize your dividend.” Activist investing is a new and very influential quest for power and influence.

The 3 D’s are impacting oil

Yale Environment 360 asked the question in a June 2021 article, “Amid Troubles for Fossil Fuels, Has the Era of ‘Peak Oil’ Arrived?” If that’s the case, then 2019 was THE year for peak oil.

What are the 3 D’s contributing to peak oil? Decarbonization; Deflation of demand; and a desire to Detoxify our air.

Oil consumption likely will decline over the next few decades. Losses and risk like this pose a large setback for big oil companies. Cars and trucks consume almost a half of the world’s oil. However, the trends will only continue to crimp their financials. The pandemic, changes to commutes, regulatory pressures, and the rapid transition to electric vehicles.

Stop drilling now to meet 2050 net-zero targets

A respected energy authority warned that 2020 was THE year the world would need to stop drilling for new oil and gas wells in order to meet net-zero emissions targets set for 2050.

Hang on… this transition to a lower-carbon emissions future will be a wild ride. What matters most now is what we do about this inevitable transition to cleaner energy. Go COP26 – this is where that cooperation happens. And its possible that these energy companies will lead the way – if they get smart about the risk and help to fuel that transition.

Peak Sustainability Group coaches businesses and municipalities on ways to lower their carbon footprint. We also work with businesses seeking to implement sustainability into their operations.